Join Alexandre Laizet in this investor Q&A video on Capital B's Bitcoin accumulation strategies, yield maximization, market challenges, expansions, and future innovations as Europe's leading BTC treasury company.

Timestamp Overview

[00:00:00 - 00:02:50] Introduction and Company Overview

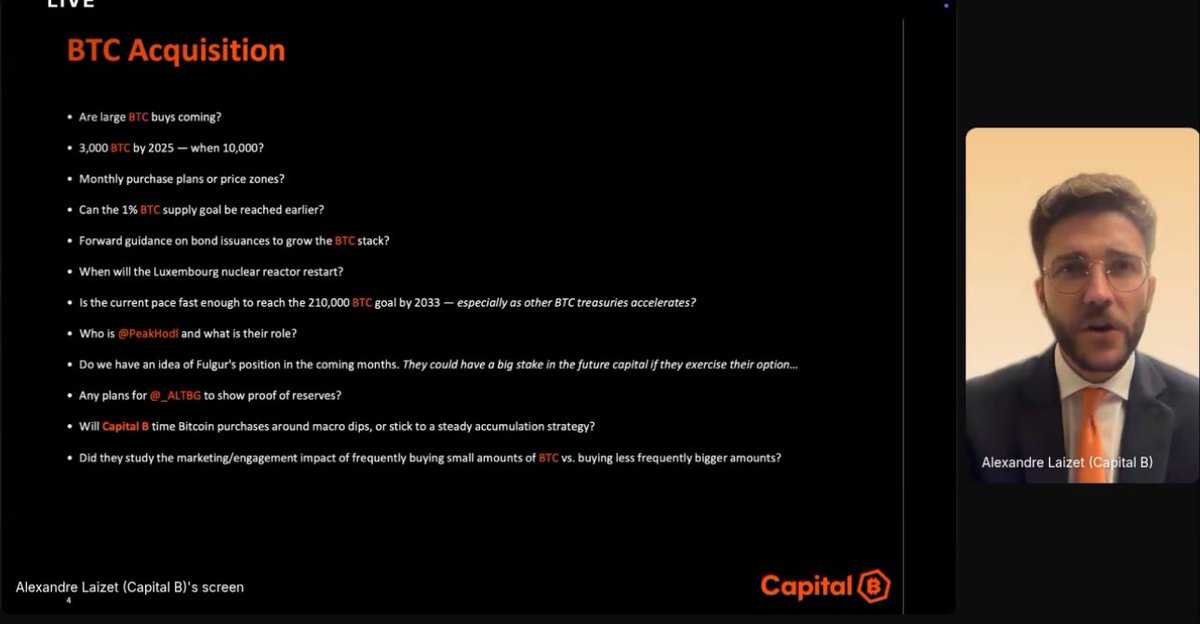

- Alexandre greets viewers and explains this is the first video update to answer investor questions from X.

- He shares his screen to show a list of questions grouped by topics like BTC buys, yields, and market feelings.

- Capital B is introduced as Europe’s first Bitcoin treasury company listed on a stock exchange.

- The main goal is to increase the number of Bitcoin per share through regular buys and big deals.

[00:02:50 - 00:05:14] Bitcoin Accumulation Targets and Strategies

- The company aims for 3,000 BTC by 2025 but hopes to exceed it, with long-term goals of 21,000 BTC in three years and 210,000 by 2033.

- They’ve already reached over 2,000 BTC, adding more than 50 recently, and are ahead of their plan.

- They buy Bitcoin regularly without waiting for price drops, using all available money quickly.

- No forward plans on bond sales for more BTC, but they can issue BTC-based bonds anytime.

[00:05:14 - 00:07:48] Share Price History and Future Deals

- Share price dropped sharply earlier this year but recovered after big transactions that took 1-3 months to complete.

- Similar future deals could greatly impact the company positively.

- They’re working hard on operations like restarting a Luxembourg setup, with daily meetings worldwide.

- The pace to reach 1% of all BTC by 2033 is on track, despite new competitors emerging.

[00:07:48 - 00:09:28] Competition and Growth Comparison

- Bitcoin treasury companies compete to buy BTC but also help each other by promoting BTC adoption.

- Capital B has grown from 40 BTC last year to 2,000 now, giving huge returns like 1,400% BTC yield this year.

- This growth has attracted big investors and even short sellers who bet against the stock.

- Compared to others like MicroStrategy, their pace is strong when adjusted for starting time and market.

[00:09:28 - 00:11:58] Market Impacts and Capital Raising

- Short sellers affect short-term prices but could become buyers later based on BTC moves or company deals.

- More companies adopting BTC helps Capital B raise money as it converts traditional assets to BTC.

- Only a tiny fraction of global money is in BTC yet, so there’s huge potential for more inflows.

- Plans like rebranding, US stock listing, and Abu Dhabi office could speed up growth.

[00:11:58 - 00:14:35] Investor Details and Tokenization

- PeakHODL invested recently and may help tokenize shares for 24/7 trading directly with BTC.

- Tokenization allows shares to trade anytime in wallets, boosting access without needing more investor details.

- No updates on Fulgur Ventures’ position, but they’re a key investor holding potentially 44% if converted.

- The company’s investors are mostly long-time Bitcoin fans, which is a big strength.

[00:14:35 - 00:17:56] Proof of Reserves and Buying Approach

- As a public company, audits happen twice a year with trusted banks handling BTC safely.

- No short-term plans for public proof of reserves, but it’s not ruled out.

- They don’t time buys for price dips because the focus is getting BTC quickly, not predicting markets.

- Past timing attempts would have led to fewer BTC overall.

[00:17:56 - 00:20:47] Marketing and Capital Yield in Tough Markets

- Frequent small buys aren’t for marketing; the goal is fast accumulation when cash is ready.

- Company value comes from BTC on balance sheet, growth in BTC per share, and market premium.

- Premium depends on future BTC yield potential, like earnings in traditional companies.

- In bad markets, premium might drop, but they can still raise money through special bonds.

[00:20:47 - 00:23:28] Bear Market Strategies

- Bear markets make raising harder, but tools like BTC bonds have built-in premiums to help.

- They’re considering preferred stocks like other companies to keep accumulating BTC.

- Even in downturns, investor shifts could limit losses as money flows back to BTC.

- BTC treasury companies might change how bear markets work by steadily buying BTC.

[00:23:28 - 00:25:34] Dilution and Instrument Details

- Warrants from earlier can be exercised to add more BTC; faster exercise helps accumulation.

- They’ll update on how operations add value without real dilution on a BTC basis.

- Raises aren’t backed by BTC but some are in BTC with long terms for company growth.

- If goals aren’t met in 5 years, investors might get BTC back, but that’s unlikely.

[00:25:34 - 00:28:03] Fund Partnerships and Yield Products

- No current plans for a yield fund with partner TOBAM, but their program already adds extra yield.

- TOBAM gets special prices for buying shares, helping them outperform.

- No comments on option income products yet; updates if they happen.

- To raise value, focus on more capital, BTC buys, and better communication.

[00:28:03 - 00:30:17] Hiring and Regulations

- Hiring to speed up tasks like US listing and executions for faster BTC growth.

- French/EU rules are tough but create barriers, making Capital B unique in Europe.

- This gives access to big European debt markets for future growth.

- Scaling in Europe could lead to huge balance sheet increases like others in the US.

[00:30:17 - 00:33:50] Advantages in Europe vs. Other Markets

- Europe has liquid markets and demand for BTC treasuries, shown by high performance and liquidity.

- BTC treasuries appeal for indirect BTC exposure due to taxes and privacy.

- Share price drops despite BTC rises due to summer lows, shorts, and new competitors.

- But long-term, performance is measured in BTC yield, which is up hugely.

[00:33:50 - 00:36:06] Risks and Long-Term Focus

- Investing has risks like BTC volatility, bank issues, and operations.

- Fiat money prints endlessly, but BTC is limited, making it strong long-term.

- Short sellers may lose betting against a BTC-focused company.

- Volatility is a chance for convinced investors to buy low.

[00:36:06 - 00:39:18] Share Price Factors and Short Sellers

- Price falls from competition drawing attention, lower summer trading, and shorts.

- But more BTC adoption overall helps; aim to beat benchmarks in yield.

- Right timeline for BTC is years, not short-term moves.

- Confident in beating shorts with deals and BTC growth.

[00:39:18 - 00:41:05] Roadmap and Metrics

- No price predictions; can’t give guidance.

- In top 25 BTC treasuries now; aim for top 20 by best raising and velocity.

- If BTC surges, contingency is raising more as adoption grows.

- PCV metric shows strong conversion of premium to value, better than traditional investments.

[00:41:05 - 00:44:07] Protecting Shareholders

- All operations increase sats per share, no real dilution if you believe in BTC.

- Use fully diluted metrics to account for future shares.

- No alliances yet with other treasuries; focus on own growth.

- Congrats to competitors like Sequence; M&A is complex.

[00:44:07 - 00:46:32] Capital Raise Updates

- June approval was for capacity to raise up to 10B euros, not an actual raise.

- It takes time; share price links to successful raises adding BTC.

- Still seeking US head; reach out if interested.

- US ticker delayed by admin issues; more updates soon.

[00:46:32 - 00:49:22] Expansions and Events

- Setting up in Abu Dhabi; open to meetings there.

- Planning events like conferences and possible investor day.

- No Lightning or DeFi focus; core is BTC per share.

- Developer team works on BTC nodes for clients, not company use.

[00:49:22 - 00:51:57] Tokenization Benefits

- Tokenizing shares adds 24/7 liquidity and BTC trading, helping yield.

- Targets BTC holders with wallets for direct access.

- Pool of capital is huge, like all BTC, and will grow with mainstream adoption.

- No min market cap for preferred shares; considering options.

[00:51:57 - 01:01:39] Governance and Closing

- Payroll aligned with investors; team fully committed with skin in game.

- More transparency coming within rules.

- Thanks to question contributors.

- Considers all investors equal; works 24/7 for them.

Notable Quotes

Bitcoin Accumulation Focus

Our goal is to accumulate as much Bitcoin as possible as fast as possible and in the most accretive way as possible.

Alexandre Laizet @AlexandreLaizet

Long-Term Targets

Our goal is to accumulate 21,000 plus BTC over three years and to go towards 210,000 BTC towards 2033.

Alexandre Laizet @AlexandreLaizet

Competition in BTC Treasuries

We are in competition to accumulate as much Bitcoin as possible. At the same time, we are cooperating into the adoption of Bitcoin on all of our balance sheets.

Alexandre Laizet @AlexandreLaizet

Volatility as Opportunity

That is why we call volatility as vitality. That is why we call volatility as opportunity.

Alexandre Laizet @AlexandreLaizet

Bear Market Strategy

The whole point of a Bitcoin treasury company is to securitize Bitcoin and issue financial instruments that will allow the company to raise capital and accumulate Bitcoin with an embedded premium.

Alexandre Laizet @AlexandreLaizet

European Advantages

What I see in Europe is scaling scarcity. Yes, there is constraints, but that means that the scarcity is higher than in other markets.

Alexandre Laizet @AlexandreLaizet

Investor Alignment

You are my priority every day. I work for you 24 7, 365. And I will continue to do so.

Alexandre Laizet @AlexandreLaizet

BTC Yield Maximization

My sole function in the company and what you expect from me every day is to raise as much capital as possible as fast as possible and to accumulate the most bitcoin possible on the balance sheet.

Alexandre Laizet @AlexandreLaizet

Short Sellers

The highest probability for short sellers is that we will be very happy to welcome them potentially in the future as future shareholders.

Alexandre Laizet @AlexandreLaizet

Tokenization Benefits

More liquidity, more access is at the end of the day, more premium potential and more BTC yield potential for our shareholders.

Alexandre Laizet @AlexandreLaizet

Questions & Answers

Question 1: Are large BTC buys coming?

Answer: As a publicly listed company, we cannot give forward-looking statements, but we update on large transactions when they happen. Focus is on maximizing Bitcoin per share through regular purchases and potential big deals.

Question 2: 3000 BTC by 2025 when 10,000?

Answer: We’ve already hit 2013 BTC and are ahead of targets. We aim to exceed 3000, with goals of 21,000 in three years and 210,000 by 2033 to reach 1% of total BTC supply.

Question 3: Monthly purchase plans or price zones?

Answer: We don’t consider fiat prices; we allocate all capital to BTC as fast as possible without timing the market.

Question 4: Forward guidance on bond issuance to grow BTC stack?

Answer: We can’t give forward statements, but we can issue BTC-denominated convertible bonds anytime via our Luxembourg SPV.

Question 5: When will the Luxembourg nuclear reactor restart?

Answer: We can’t announce unconfirmed details, but we’re working relentlessly on such operations with investors worldwide.

Question 6: Is the current pace fast enough to reach 1% of the total BTC supply by 2033, especially as other Bitcoin treasuries are emerging?

Answer: Yes, our growth from 40 to 2000 BTC shows strong pace. Competition helps adoption, and differentiation comes from velocity and aggressiveness.

Question 7: Who is peakhodl and what is their role?

Answer: PeakHODL invested in our recent equity raise and aims to tokenize shares for 24/7 trading directly with BTC via Stocker.

Question 8: Do we have an idea of Fulgur’s position in the coming months?

Answer: No updates now; we’ll announce if needed. They hold potentially 44% fully diluted and are strategic Bitcoin maximalists.

Question 9: Any plans for ALTBG to show proof of reserves?

Answer: As an audited public company, we rely on half-year and year-end audits with trusted banks. No short-term plans for cryptographic proof, but not closing the door.

Question 10: Will Capital B time Bitcoin purchases around macro dips?

Answer: No, we don’t time the market; focus is accumulating BTC as fast as possible.

Question 11: Did they study the marketing engagement impact of frequently buying small amounts of btc?

Answer: We buy as soon as possible without getting cute on pace; marketing isn’t the driver.

Question 12: Capital yield fundraising plants in a bear market?

Answer: Bear markets challenge raises, but we use instruments like BTC bonds with embedded premiums to continue accumulating.

Question 13: Expected dilution from Warrants and Convertible?

Answer: Warrants help accumulate BTC faster; we publish updates on accretion. All operations increase BTC per share on a Bitcoin standard.

Question 14: Will Raises remain BTC backed?

Answer: Raises aren’t BTC-backed; some are BTC-denominated with protective terms, but priority is equity and accretive instruments.

Question 15: Could TOBAM engineer a yield bearing fund using altbg?

Answer: Not currently; TOBAM already gains extra yield via our ATM program.

Question 16: Plans for an option Income ETF like msty?

Answer: Can’t comment now; we’ll update if involved in the future.

Question 17: What are you going to do to raise MNav?

Answer: Relentlessly raise capital, accumulate BTC, improve communication, hire talent, and issue new securities.

Question 18: Would you say French and EU regulation is more of a constraint or mode for those able to navigate it effectively?

Answer: It’s a constraint but an advantage due to higher barriers, giving us unique position in Europe’s liquid markets.

Question 19: Advantages and challenges of a Bitcoin strategy in Paris EU and how this compares to to other markets?

Answer: Challenges in rules, but high demand shown by performance. Compares well to US/Japan/UK; EU appeals for indirect BTC exposure.

Question 20: Why is the share price falling despite BTC rising?

Answer: Due to summer lows, short sellers, and attention to new competitors. Measure in BTC yield, which is up hugely; volatility is opportunity.

Question 21: Confidence in beating short sellers?

Answer: Yes, shorts provide service and may become buyers; we focus on BTC yield and deals.

Question 22: Year end share price expectations?

Answer: Can’t comment as a public company.

Question 23: Short term guidance to lift sentiment and price?

Answer: Can’t provide; focus on major transactions and partnerships.

Question 24: Top 20 BTC, treasury roadmap?

Answer: We’re top 25 now; aim for top 20 via best raising, velocity, and instruments.

Question 25: If BTC price surges. Do you have a contingency plan to keep accumulating efficiently?

Answer: Higher BTC price means more adoption, allowing us to raise more capital accretively.

Question 26: PCV Premium Compression velocity, the metric of Adam Livingstone which provides a view of how many units of premium the company is able to transform in net asset value each month is below 1. So it’s about 1070089?

Answer: Our PCV around 1 is highly accretive, converting premium to value in 4-5 months, best in class.

Question 27: How will Capital B protect existing shareholders from dilution?

Answer: All operations increase sats per share; we use fully diluted metrics and focus on long-term partners.

Question 28: Any plans to ally with other BTC treasury companies or to position defensively against similar players like Sequence entering the space?

Answer: No alliances now; focus on own craft. M&A is complex; congrats to Sequence.

Question 29: Do you have any updates regarding the 10 billion capital raise in June 10th?

Answer: It was approval for capacity up to 10B euros, not an actual raise; takes time to execute.

Question 30: Status on US Head recruitment?

Answer: Still looking for Bitcoin maximalist with raising experience; reach out if interested.

Question 31: Awareness for the US Ticker?

Answer: Delayed by admin issues; will update soon on timeline.

Question 32: Updates on Abu Dhabi?

Answer: Establishing presence; open to meetings in the region.

Question 33: Investor day planned before year end?

Answer: Considering it; attending conferences like UN, Plan B, Bitcoin Mina.

Question 34: Will Capital B adopt lightning or defi strategies?

Answer: Not core priority; focused on BTC per share. Developers work on BTC nodes for clients.

Question 35: Plans to tokenize ALTBG shares or destruction from BTC’s focus?

Answer: Tokenization adds liquidity and access, helping BTC yield; not a distraction.

Question 36: What’s the main type of expected investor that would choose tokenized shares of capital B over normal shares?

Answer: Sovereign BTC holders with wallets wanting direct BTC trading and to outperform BTC.

Question 37: How big do you think this pool of capital is for tokenized shares?

Answer: As big as BTC’s trillions, growing with mainstream access.

Question 38: Is there a minimum market cap needed to consider preferred share types?

Answer: For traditional ones, bigger helps; considering adapted versions.

Question 39: How is payroll and salary indexing managed at Capital B in broad terms?

Answer: Not public, but team is aligned with investors and all in.

Question 40: How much skin in the game does the team have?

Answer: Fully committed; remuneration tied to maximizing BTC per share.

Organizations Mentioned

- Capital B (ALTBG, Europe’s first Bitcoin treasury company, formerly The Blockchain Group)

- Euronext Growth Paris (stock exchange where listed)

- Tobam (French asset manager, partner in ATM program)

- Fulgur Ventures (strategic investor)

- Bitcoin Magazine (investor)

- UTXO Management (investor, investment arm of BTC Inc.)

- Taylor Events (mentioned as investor, possible transcription error)

- PeakHODL (investor in equity raise for tokenization)

- Stocker (Stokr, tokenization platform in Luxembourg)

- Banque Delubac (Bitcoin custody bank in France)

- Swissquote (regulated bank in Luxembourg/Switzerland for custody)

- MicroStrategy (referred to as Strategy, benchmark Bitcoin treasury)

- Meta Planet (Japanese Bitcoin treasury company)

- Smarter Web Company (European Bitcoin treasury)

- H100 (Bitcoin treasury company)

- Semler (Bitcoin treasury company)

- Sequans (US Bitcoin treasury company)

- Blockstream (developer of Liquid sidechain for tokenization)